Capital Uses

We partner with the best management teams to provide true long-term financing without refinancing risk, allowing entrepreneurs to maintain control of the operations and long term objectives. Alaris has invested over $1.8 billion to date in over 35 companies.

- Width: wide

- Align: center

- Color: blue

- Image: /upload/section_settings/12/2b34000e17cf/05e7dd7b-aedc-4f9e-be47-dbfab05dbb85.png

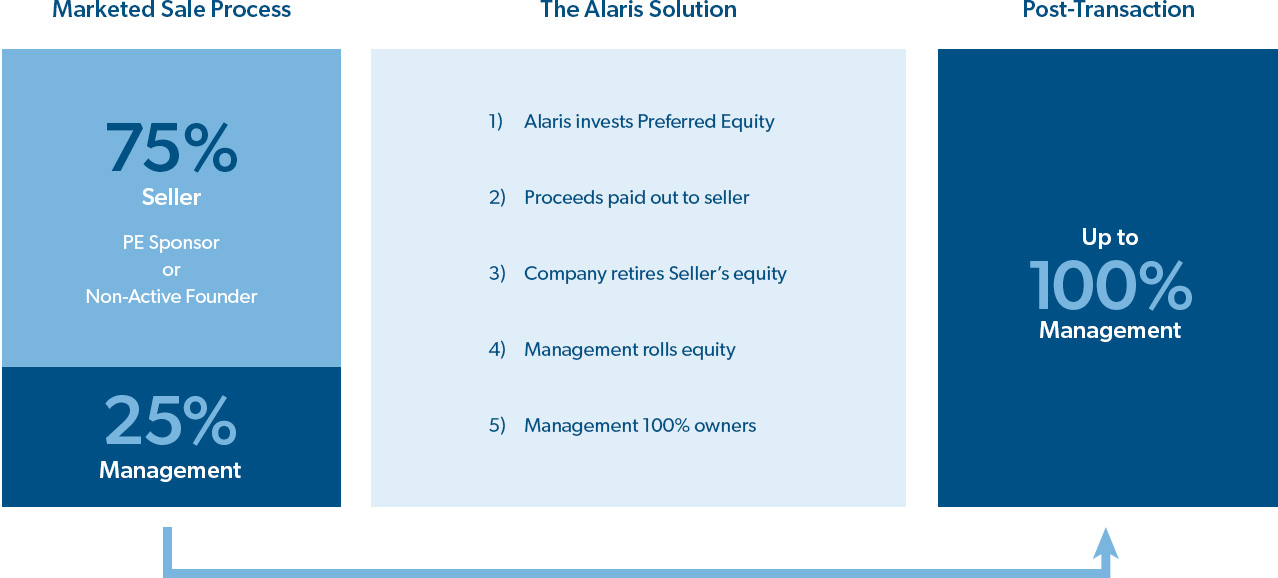

The Preferred MBO

A creative solution that positions Management as competitive buyers for exiting equity shareholders

- Width: wide

- Align: left

- Color: white

- Image:

Business Owners have used Alaris to buyout their exiting shareholders and in the process, consolidate control of the common equity in their business where they have the ability to control the operations, strategic vision, culture and time horizon all while benefiting from the majority of the upside in the growth that they deliver.

MANAGEMENT BUYOUT OF PRIVATE EQUITY

Federal Resources

Federal Resources

Case Study

Description

2015

US$67.0M (3 tranches)

Leading distributor of chemical, biological, radiological, nuclear and explosive detection and protection equipment.

Situation

The company had a highly qualified management group who had successfully executed the business model over the prior years. As the company embarked on the next phase of growth, their goal was to find a partner who could help provide the existing sponsor with a liquidity event and allow the management team to control the strategic vision, operations and culture of the business.

Federal Resources used the intial proceeds from the Alaris investment to complete a management buyout of an existing equity sponsor as well as for the partial monetization of other minority shareholders. Subsequent proceeds were used for acquisitions.

Outcome

"We are grateful and excited about the opportunity. My team and I are looking forward to accomplishing great things during our partnership with Alaris."

– Robbie McWilliams, CEO, Federal Resources

LifeMark Health

Exited

LifeMark Health

Case Study

Description

2004

CAD$67.5M (7 tranches)

National physiotherapy services.

Situation

Alaris backed an impressive management team who also contributed significant equity to help align interests. Management had laid out a growth through acquisition strategy for physiotherapy clinics in the heavily fragmented industry across Canada. Management believed that they could use Alaris’ non-control preferred equity alongside senior debt and cash from operations to accretively fund acquisitions of clinics.

Outcome

Alaris provided an initial investment to help finance a management buyout of Lifemark.

Throughout the next seven years, Alaris provided six follow-on investments that were utilized together with senior debt to provide management with the capital needed to grow their business from 35 locations to over 100.

In June 2011, Lifemark was acquired by Centric Health in which Alaris rolled a portion of is preferred equity investment to help facilitate the transaction. Alaris’ remaining financial interest was sold in 2016 closing out a 12 year investment.

Sequel Youth and Family Services

Exited

Sequel Youth and Family Services

Case Study

Description

2013

US$73.5M (2 tranches)

Premier national provider of diversified behavioral health services.

Situation

Sequel was seeking a new financial partner to take out its existing equity sponsor and some other equity holders and to provide capital to continue growing our company. Sequel was looking for a partner that wasn’t dictating an exit time line.

Outcome

“The financial architecture with Alaris provided was a wonderful solution because it 1) provides for an increasing share of the enterprise value of the company to common shareholders as as grew, 2) is permanent capital since it did not require us to sell or refinance at any point in the future, and 3) allowed us to retain control over the operations of the company.

Plus the folks at Alaris are great people and fantastic to work with.”

– Jay Ripley, Co-Founder & Chairman, Sequel Youth & Family Services

GWM Holdings, Inc.

GWM Holdings, Inc.

Case Study

Description

2018

US$46.0M

Leading data-driven digital marketing provider for advertisers globally.

Situation

The Management team at GWM was seeking a partner with an indefinite time horizon and one that would allow them to preserve their culture.

Outcome

Alaris made a non-control preferred equity investment which was used to facilitate an d exit for a controlling equity partner in the business. As a result of using Alaris’ preferred equity to fund the exiting liquidity event, the management teams rolled equity stake allowed them to become controlling shareholders.

Management Buyout of Founder / Partner

Falcon Master Holdings LLC

Falcon Master Holdings LLC

Case Study

Description

2021

US$40.0M

Largest full-service title and settlement company, specializing in reverse mortgages.

Situation

FNC was seeking a partner that could facilitate a partial liquidity event for the equity holders and help execute on their growth strategy. Due to management’s exceptional depth and experience in their industry, maintaining control over the strategic vision and operations was a leading priority in the search for a new capital partner.

Outcome

Alaris made a non-control preferred equity investment which allowed the equity holders to achieve their liquidity goals today as well as align themselves with a capital provider who does not have a time horizon on their capital and can provide continued access to capital.

Management continues to execute their business plan as they see fit, preserve the culture that they had worked hard to establish and benefit from the majority of the growth that they create as operators since Alaris’ participation in the growth of the business is capped via a collar.

Edgewater Technical Associates, LLC

Edgewater Technical Associates, LLC

Case Study

Description

2021

US$34.0M

Leading technical and professional services firm specializing in the Department of Energy (“DOE”) nuclear complex.

Situation

The owners of Edgewater were seeking a solution to help facilitate a transition of ownership in the business to the active management team of Edgewater in an effort to preserve the legacy of the business.

Outcome

Alaris made a non-control preferred equity investment which was used to facilitate a partial management buyout of the founding resulting in management significantly increasing their pro-rata common equity ownership of the business.

The Alaris structure allowed for the management team to continue to execute on its vision and preserve the Edgewater culture.

Carey Electric Contracting, LLC

Carey Electric Contracting, LLC

Case Study

Description

2020

US$17.0M

A third-generation, family-owned, electrical contracting services company for the industrial, commercial, and residential markets.

Situation

The owners of Carey were seeking a solution that would allow the long-time dedicated management team of Carey to succeed current management as the leaders of the business, while preserving the legacy of the business.

Outcome

Alaris made a non-control preferred equity investment which was used to provide partial liquidity to the owner of Carey while providing a solution where the management team would see their pro-rata common equity ownership of the business increase.

The Alaris structure allowed for the management team to continue to execute on its vision with no exit time horizon.

Heritage Restoration, LLC

Heritage Restoration, LLC

Case Study

Description

2017

US$15.0M

Specialty contractor providing masonry and masonry related services in New England.

Situation

The founder of Heritage was seeking a solution that would allow the long-time dedicated management team of Heritage to become the controlling shareholders and preserve the legacy of the business.

Alaris’ preferred equity solution was ideal given the cap on upside participation.

Outcome

Alaris made a non-control preferred equity investment which was used to redeem the founder’s common equity units in the business resulting in the management team becoming controlling shareholders.

The Alaris structure allowed for the management team to continue to execute on their vision and while not having a time horizon to be refinanced.

DNT Construction

DNT Construction

Case Study

Description

2015

US$70.0M

Leading provider of civil construction services.

Situation

The founder of DNT was seeking a solution that would allow the management team of DNT to acquire his majority share of the business.

Management was focused on finding a solution that would allow them to control the operations, culture and vision of the business. Seeking a capital provider that would mitigate any possible refinancing risk was essential to completing a transaction.

Outcome

Alaris made a non-control preferred equity investment which was used to redeem the founders common equity units in the business resulting in the management team seeing their pro-rata common equity ownership of the business increase to 100%.

The Alaris structure allowed for the management team to continue to execute on their vision and does not have a time horizon to be refinanced.

Unify

Unify

Case Study

Description

2016

US$25.0M (2 tranches)

Seattle, Washington based management IT consulting firm that provides companies with local, customized consulting solutions.

Situation

The ownership group of Unify had spent years successfully building out the depth of their IT Consulting talent base and brand. The company was seeking a capital partner which would allow one of the partners to buy out a majority partner and maintain control of the business. Finding a partner who had the ability to continue to deploy capital with a longer-term time horizon was an important aspect to a transaction.

Outcome

The Alaris investment was used to redeem the majority partner’s common equity and resulted in the remaining partner becoming the controlling shareholder of the business.

Partnering with Alaris also provides continued access to capital to assist management in executing its growth plan, which doesn’t require a repurchase or exit and gives management the ability to continue to deploy capital as it sees fit.

“Alaris has been the perfect non-controlling capital partner to allow Unify to focus on our consultants and our culture and do what is right for our clients long-term. Alaris understands and respects our values and we are extremely grateful for the continued confidence in our mission."

– Darren Alger, President and Chief Executive Officer, Unify.

Sales Benchmark Index

Exited

Sales Benchmark Index

Case Study

Description

2017

US$85.0M

Leading US based management consulting firm specializing in sales and marketing that is dedicated to helping their clients deliver their revenue growth numbers.

Situation

SBI was seeking a capital provider which would allow the continuing partners to buyout a retiring partner and maintain control of the business.

Outcome

“The SBI team found the Alaris partnership to be an ideal match. When weighing our options, the Alaris model was the perfect fit because it allows entrepreneurs to retain operating control and the majority of the equity in their business. Alaris behaved like a true partner from day 1 and the cultural alignment made it a very easy decision as we get ready for our next wave of growth.”

– Matt Sharrers, CEO, Sales Benchmark Index

- Width: wide

- Align: left

- Color: gray

- Image:

Dividend Recapitalization

Business Owners seeking to monetize a significant portion of the equity built up in their business today, but who also want to remain in control of their business and continue to dictate time horizon while being the largest participant in the future growth of their business, have used Alaris to facilitate these ambitions.

The Shipyard, LLC

The Shipyard, LLC

Case Study

Description

2023

$42.5m (preferred equity)

$17.0m (minority common equity)

Business Services: Fully Integrated Marketing Platform.

Situation

The owners of Shipyard were looking for a partner to provide partial liquidity while continuing operate the business and maintaining its corporate culture. The Shipyard wanted a partner that could enhance strategic initiatives as the company actively executes its growth strategy.

Outcome

Alaris made a preferred equity investment of $48M while also making a common equity investment of $17M. Proceeds were used for a partial liquidity event for the owners.

Sagamore Plumbing and Heating LLC

Sagamore Plumbing and Heating LLC

Case Study

Description

2022

US$20.0M (preferred units)

US$4.0M (common equity)

Industrials: Commercial Plumbing, HVAC and Facilities Maintenance Services.

Situation

Sagamore's founder was looking for partial liquidity while continuing to operate the business and its corporate culture while maintaining its legacy. Sagamore wanted to form a partnership that would allow him to pursue growth opportunities.

Outcome

Alaris made a preferred equity investment of $20M while also making a common equity investment of $4M. Proceeds were used for a partial liquidity event for the owner.

3E

3E

Case Study

Description

2021

US$22.5M

Leading utility service provider that installs, inspects, maintains and replaces critical infrastructure (primarily natural gas utilities) for blue-chip, investor-owned utility companies.

Situation

3E’s owners were seeking a partner that would allow them to continue to execute upon their business model and who also shared their long-term vision to build out a legacy business.

Outcome

Alaris made a non-control preferred equity investment to recapitalize its balance sheet and will provide access to additional capital to fund its growth strategy.

Brown & Settle Investments, LLC

Brown & Settle Investments, LLC

Case Study

Description

2021

US$66.0M

Leading provider of site preparation services serving the data center market.

Situation

The owners of B&S were seeking a partner that could facilitate a liquidity event for equity holders and help execute on their growth strategy.

Outcome

Alaris made a non-control preferred equity investment which was used to provide partial liquidity to the owners of B&S and allowed the management team maintain their common equity ownership of the business.

The Alaris structure allowed for the management team to continue to execute on its vision and pursuit of further growth opportunities.

Falcon Master Holdings LLC

Falcon Master Holdings LLC

Case Study

Description

2021

US$40.0M

Largest full-service title and settlement company, specializing in reverse mortgages.

Situation

FNC was seeking a partner that could facilitate a partial liquidity event for the equity holders and help execute on their growth strategy. Due to management’s exceptional depth and experience in their industry, maintaining control over the strategic vision and operations was a leading priority in the search for a new capital partner.

Outcome

Alaris made a non-control preferred equity investment which allowed the equity holders to achieve their liquidity goals today as well as align themselves with a capital provider who does not have a time horizon on their capital and can provide continued access to capital.

Management continues to execute their business plan as they see fit, preserve the culture that they had worked hard to establish and benefit from the majority of the growth that they create as operators since Alaris’ participation in the growth of the business is capped via a collar.

FMP

FMP

Case Study

Description

2023

US36.5M

FMP is a leading-edge professional services firm that provides evidence-based workforce and organizational management solutions to transform the public sector.

Situation

The owners of FMP were looking for a partner that would allow them to continue to operate the business with no change to corporate culture while providing guidance when called upon.

Outcome

Alaris made a non-control preferred equity investment of $30.5M while also making an investment in common equity of $6.0M. Proceeds were used for a partial liquidity event by the owners.

Planet Fitness Growth Partners (PFGP)

Planet Fitness Growth Partners (PFGP)

Case Study

Description

2014

US$88.0M (3 tranches)

Leading franchisee of Planet Fitness® health clubs.

Situation

PFGP was looking for capital to expand their business, and to provide a partial liquidity event for certain equity holders.

Outcome

PFGP has been able to increase the number of clubs from 15 to over 50 today, and continues to grow. This has increased the economic interests of PFGP equity holders substantially.

Alaris' business model was exactly what we were looking for in an investor. We wanted capital to help us grow our business while still maintaining control. Alaris is allowing us to do that."

– Victor Brick, CEO, Planet Fitness

Providence

Providence

Case Study

Description

2016

US$30.0M

Leading provider of design, engineering, development, manufacturing, and sourcing services for international apparel companies and retailers.

Situation

Providence was exploring options to identify a partner that had the ability to grow alongside them with additional capital to help fund growth while at the same time, providinga liquidity event for certain equity holders.

Maintaining the culture and having the ability to control the operational and strategic vision of the business were of utmost importance to the founders.

Outcome

Alaris made a non-control preferred equity investment which allowed the founders to achieve their goals today as well as align themselves with a capital provider who does not have a time horizon on their capital and can provide continued access to capital.

Management continues to execute their business plan as they see fit, preserve the culture that they had worked hard to establish and benefit from the majority of the growth that they create as operators since Alaris’ participation in the growth of the business is capped via a collar.

Solowave

Exited

Solowave

Case Study

Description

2010

$42.5 (2 tranches)

Leading designer and manufacturer of wooden outdoor active play and modular structures.

Situation

The Solowave team had spent years building a high quality business in a very niche sector of the wooden outdoor play space.

The founders were seeking a partner that could facilitate a liquidity event for certain equity holders and execute on their growth strategy, and also allow management to maintain control over operations. Maintaining the culture that they had established was a key to the owners.

Outcome

Alaris’ original investment provided a dividend recap for the common equity holders of the business and was followed by a subsequent second tranche of Alaris capital to help fund a new division of the business.

In September of 2016 the common equity holders sold the business which saw Alaris sell its preferred equity units along side the common equity holders. Due to the collar on the growth participation of Alaris’ distribution, the common equity holders were able to experience a much more beneficial portion of the sale proceeds then they would have if they had sold their common equity in the original liquidity transaction 5 years prior.

Stride Consulting, LLC

Stride Consulting, LLC

Case Study

Description

2019

US$6.0M

Leading Agile software development consultancy

Situation

Stride was exploring options to identify a partner that had the ability to grow alongside them with additional capital to help fund growth while at the same time, providing a liquidity event for equity holders.

Maintaining the culture and having the ability to control the operational and strategic vision of the business were utmost importance to the founder.

Outcome

"I am delighted to partner with Alaris, with the number of options in the market we are very fortunate to be partnering with a group that allows us to maintain our culture and the majority of upside in future growth. Stride is built off its tremendous workforce, therefore finding a financial partner that keeps our innovative culture and entrepreneurial DNA was essential to Stride. At Stride, we have worked very hard to create the leading Agile software development consultancy in New York City and look forward to continuing to provide our clients with significant and permanent improvements in their software development capabilities."

– - Debbie Madden, Founder and CEO Stride Consulting

Amur Financial Group, Inc.

Amur Financial Group, Inc.

Case Study

Description

2019

US$70.0M

One of Canada’s leading fully integrated independent originator, manger and servicer of home equity loans.

Situation

Amur was seeking a partner that could facilitate a liquidity event for certain equity holders and help execute on their growth strategy. Due to managements exceptional depth and experience in their space, maintaining control over the strategic vision and operations was a leading priority in the search for a new capital partner.

Outcome

"Our executive team spent a significant amount of time reviewing its recapitalization options. Almost immediately Alaris stood out as the best fit. With a focus on supporting our long-term growth aspirations, and not a quick exit, it was clear that Alaris' investment model was designed specifically for companies like ours. We look forward to working with a great group of professionals and are proud to be a part of the Alaris group of companies."

- Kurt Wipp, Managing Director, Amur Financial

Body Contour Centers, LLC

Body Contour Centers, LLC

Case Study

Description

2018

US$46.0M

Largest multi-site private cosmetic surgery practice in the United States.

Situation

Body Contour was looking for capital to provide a partial liquidity to the founder and other original investors.

Outcome

Management chose to partner with Alaris as a flexible capital solution allows the company to pursue its vision for growth, while also recapitalizing the balance sheet in a prudent way.

“We are excited to embark on the next phase of growth via this partnership with Alaris. Their flexible capital solution will allow our management team to pursue our vision for growth while recapitalizing our balance sheet in a prudent way. We look forward to a long and successful relationship with Alaris.”

– Chris M. Par, Chief Executive Officer, Body Contour Centers, LLC

Fleet Advantage, LLC

Fleet Advantage, LLC

Case Study

Description

2018

US$15.0M

Truck leasing organization and syndication company that utilizes data analytics to help corporate clients manage large private truck fleet productivity and costs.

Situation

Fleet Advantage was looking for capital for continued growth and provide liquidity to existing shareholders.

Outcome

Alaris made a non-control preferred equity investment which allowed the shareholders to achieve their goals today as well as align themselves with a capital provider who can provide continued access to capital.

Quetico

Exited

Quetico

Case Study

Description

2011

US$26.9M

Specialized wholesale, inventory management, and third party logistics services.

Situation

Founded in 1994, Quetico has created a highly specialized and proprietary wholesale and inventory management niche within the logistics industry.

As the company had grown and built out its business, the business owners had to re-invest a lot of their profits back into the business and were seeking to find a capital provider who could provide some liquidity but at the same time, maintain control over their operations, culture and vision for the business.

Outcome

"We could not have been more pleased with our three year association with Alaris. They have been excellent partners and allowed us to do things financially that we could not have done otherwise. Their entire team has been a pleasure to work with and we will miss our friendly interaction with the group. We are only redeeming their investment as the nature of our business has changed, diminishing our need for the extra working capital Alaris had provided. We would not hesitate to approach Alaris in the future if the need once again arises.”

– Tom Fenchel, Co-Founder, Quetico

C & C Communications

C & C Communications

Case Study

Description

2016

US$19.2M (4 tranches)

One of the largest Sprint retailers in the network with over 60 locations.

Situation

ccComm was seeking a capital provider to help facilitate a recapitalization of the business and allow the owners to realize some liquidity, while providing access to capital for future acquisitions.

Outcome

Alaris made a non-control preferred equity investment which allowed the founders to achieve their goals today as well as align themselves with a capital provider who can provide continued access to capital.

SCR Mine Technologies

SCR Mine Technologies

Case Study

Description

2013

US$40.0M

Mining service provider in Northern Ontario.

Situation

The founders were seeking a partner that could facilitate a liquidity event for certain equity holders but would not require unnecessary alteration in the way that they have historically operated their successful business.

Maintaining the culture that they have established was key to the owners.

Outcome

"We joined forces with the Alaris group in May 2013 with no regrets, issues or complaints. Our original intent was to have a financial partner that would offer us flexibility, assist in accelerating our future growth and that would allow us to keep operating as we have done in the last 20 years. We are happy to have the Alaris group as partners as we find them to be friendly, easy to deal with and down to earth."

– Claude Séguin, Co-Owner, SCR Mining & Tunnelling L.P

LMS Reinforcing Steel Group

LMS Reinforcing Steel Group

Case Study

Description

2007

US$59.8M (4 tranches)

Leading independent fabricator and installer of reinforcing steel (rebar) in North America.

Situation

LMS was looking for capital to expand their business, and to provide shareholder liquidity.

Outcome

Alaris’ original investment provided a majority divided recap for the common majority equity holders of the business and was followed by an additional tranche of Alaris capital to help fund greenfield expansion and an acquisition in California, 9 years later.

Alaris’s structure allowed management to have patience and find the right acquisition versus an aggressive acquisition strategy.

D&M Leasing

D&M Leasing

Case Study

Description

Founded in 1976, Vehicle Leasing Holdings, LLC, doing business as D&M Leasing ("D&M") is the largest independent direct-to-consumer provider of vehicle sourcing and leasing services in the United States.

Situation

The owner of D&M was seeking a partner that could facilitate a partial liquidity event while helping execute their growth strategy.

Outcome

Alaris made a preferred equity investor of $62.5m while also making a common equity investment of $7.5M. Proceeds were used for a partial liquidity even for the owner.

- Width: wide

- Align: left

- Color: white

- Image:

Growth or Acquisition

Business Owners who have ambitions to build their business with a long term mindset have used Alaris to help fund their continuing growth. Alaris provides continuous access to equity capital and this encourages Business Owners to make long term decisions while providing them with more of the upside than they would achieve under a traditional PE relationship.

LifeMark Health

Exited

LifeMark Health

Case Study

Description

2004

CAD$67.5M (7 tranches)

National physiotherapy services.

Situation

Alaris backed an impressive management team who also contributed significant equity to help align interests. Management had laid out a growth through acquisition strategy for physiotherapy clinics in the heavily fragmented industry across Canada. Management believed that they could use Alaris’ non-control preferred equity alongside senior debt and cash from operations to accretively fund acquisitions of clinics.

Outcome

Alaris provided an initial investment to help finance a management buyout of Lifemark.

Throughout the next seven years, Alaris provided six follow-on investments that were utilized together with senior debt to provide management with the capital needed to grow their business from 35 locations to over 100.

In June 2011, Lifemark was acquired by Centric Health in which Alaris rolled a portion of is preferred equity investment to help facilitate the transaction. Alaris’ remaining financial interest was sold in 2016 closing out a 12 year investment.

Planet Fitness Growth Partners (PFGP)

Planet Fitness Growth Partners (PFGP)

Case Study

Description

2014

US$88.0M (3 tranches)

Leading franchisee of Planet Fitness® health clubs.

Situation

PFGP was looking for capital to expand their business, and to provide a partial liquidity event for certain equity holders.

Outcome

PFGP has been able to increase the number of clubs from 15 to over 50 today, and continues to grow. This has increased the economic interests of PFGP equity holders substantially.

Alaris' business model was exactly what we were looking for in an investor. We wanted capital to help us grow our business while still maintaining control. Alaris is allowing us to do that."

– Victor Brick, CEO, Planet Fitness

Sandbox

Exited

Sandbox

Case Study

Description

2016

US$35.0M (2 tranches)

Full service marketing and advertising agency.

Situation

The management group at Sandbox had been executing a strategy to acquire regional marketing communication companies that complement the agency’s current operations, which will further diversify the existing client base, skill set, and industry experience.

As the company looked to continue to execute upon this business model, they were in search for a capital partner who shared their long-term vision to build out a world class marketing and advertising agency at a pace that made sense for the long-term health of the business.

Outcome

Alaris’ first investment in Sandbox allowed the company to recapitalize its balance sheet and set the company up with access to further capital to fund its growth strategy.

Sandbox management has the ability to continue to grow their business via acquisition knowing they have a long-term capital partner in Alaris who can help fund that growth for an indefinite time period. This has already proven valuable as Alaris has provided a second tranche to fund an acquisition for Sandbox.

At the same time, the culture instilled in the business was preserved which was paramount to the success of the business plan.

Sequel Youth and Family Services

Exited

Sequel Youth and Family Services

Case Study

Description

2013

US$73.5M (2 tranches)

Premier national provider of diversified behavioral health services.

Situation

Sequel was seeking a new financial partner to take out its existing equity sponsor and some other equity holders and to provide capital to continue growing our company. Sequel was looking for a partner that wasn’t dictating an exit time line.

Outcome

“The financial architecture with Alaris provided was a wonderful solution because it 1) provides for an increasing share of the enterprise value of the company to common shareholders as as grew, 2) is permanent capital since it did not require us to sell or refinance at any point in the future, and 3) allowed us to retain control over the operations of the company.

Plus the folks at Alaris are great people and fantastic to work with.”

– Jay Ripley, Co-Founder & Chairman, Sequel Youth & Family Services

Solowave

Exited

Solowave

Case Study

Description

2010

$42.5 (2 tranches)

Leading designer and manufacturer of wooden outdoor active play and modular structures.

Situation

The Solowave team had spent years building a high quality business in a very niche sector of the wooden outdoor play space.

The founders were seeking a partner that could facilitate a liquidity event for certain equity holders and execute on their growth strategy, and also allow management to maintain control over operations. Maintaining the culture that they had established was a key to the owners.

Outcome

Alaris’ original investment provided a dividend recap for the common equity holders of the business and was followed by a subsequent second tranche of Alaris capital to help fund a new division of the business.

In September of 2016 the common equity holders sold the business which saw Alaris sell its preferred equity units along side the common equity holders. Due to the collar on the growth participation of Alaris’ distribution, the common equity holders were able to experience a much more beneficial portion of the sale proceeds then they would have if they had sold their common equity in the original liquidity transaction 5 years prior.

Accscient

Accscient

Case Study

Description

2017

US$38.0M (4 tranches)

Leading provider of IT Consulting, Staffing and Outsourcing Services.

Situation

Accscient was seeking a partner to help position the company to capitalize on long term growth initiatives.

Outcome

Alaris’ initial investment was used for retiring mezzanine debt and for general working capital purposes.

"Accscient is a multi-company organization led by several entrepreneurial Presidents with businesses, goals and aspirations that are aligned. Alaris encouraged us to meet with both the members of their team, and their business partners, and we quickly determined that our goals, cultures and aspirations were also aligned with theirs. In our world of complex financial structures and transactions, we were fortunate to have had supportive partners in the past which allowed us to get to this juncture but, finding a partner that is 100% like-minded, has been one of my greatest challenges for the past 2 decades. I firmly believe Alaris is that partner."

– Sravan Vellanki, Chairman & CEO, Accscient

C & C Communications

C & C Communications

Case Study

Description

2016

US$19.2M (4 tranches)

One of the largest Sprint retailers in the network with over 60 locations.

Situation

ccComm was seeking a capital provider to help facilitate a recapitalization of the business and allow the owners to realize some liquidity, while providing access to capital for future acquisitions.

Outcome

Alaris made a non-control preferred equity investment which allowed the founders to achieve their goals today as well as align themselves with a capital provider who can provide continued access to capital.

Mid-Atlantic Health Care

Exited

Mid-Atlantic Health Care

Case Study

Description

2015

US$13.0M (3 tranches)

Skilled Nurse and rehabilitation provider.

Situation

MAHC was seeking a financial partner that could help fund the acquisition of additional interests in skilled nursing facilities.

Outcome

“We are not satisfied with anything less than the highest quality healthcare. We expect our facilities to provide a caring environment, the best hands-on clinical and nursing services and the best rehabilitation services in each community we serve. Having Alaris as a partner will allow us to focus on our goals because of the long-term nature of their capital. We are looking forward to this new partnership with Alaris and what we can achieve with them by our side.”

– Dr. Scott Rifkin, Co-Founder and CEO, MAHC Holdings, LLC

Stride Consulting, LLC

Stride Consulting, LLC

Case Study

Description

2019

US$6.0M

Leading Agile software development consultancy

Situation

Stride was exploring options to identify a partner that had the ability to grow alongside them with additional capital to help fund growth while at the same time, providing a liquidity event for equity holders.

Maintaining the culture and having the ability to control the operational and strategic vision of the business were utmost importance to the founder.

Outcome

"I am delighted to partner with Alaris, with the number of options in the market we are very fortunate to be partnering with a group that allows us to maintain our culture and the majority of upside in future growth. Stride is built off its tremendous workforce, therefore finding a financial partner that keeps our innovative culture and entrepreneurial DNA was essential to Stride. At Stride, we have worked very hard to create the leading Agile software development consultancy in New York City and look forward to continuing to provide our clients with significant and permanent improvements in their software development capabilities."

– - Debbie Madden, Founder and CEO Stride Consulting

Providence

Providence

Case Study

Description

2016

US$30.0M

Leading provider of design, engineering, development, manufacturing, and sourcing services for international apparel companies and retailers.

Situation

Providence was exploring options to identify a partner that had the ability to grow alongside them with additional capital to help fund growth while at the same time, providinga liquidity event for certain equity holders.

Maintaining the culture and having the ability to control the operational and strategic vision of the business were of utmost importance to the founders.

Outcome

Alaris made a non-control preferred equity investment which allowed the founders to achieve their goals today as well as align themselves with a capital provider who does not have a time horizon on their capital and can provide continued access to capital.

Management continues to execute their business plan as they see fit, preserve the culture that they had worked hard to establish and benefit from the majority of the growth that they create as operators since Alaris’ participation in the growth of the business is capped via a collar.

LMS Reinforcing Steel Group

LMS Reinforcing Steel Group

Case Study

Description

2007

US$59.8M (4 tranches)

Leading independent fabricator and installer of reinforcing steel (rebar) in North America.

Situation

LMS was looking for capital to expand their business, and to provide shareholder liquidity.

Outcome

Alaris’ original investment provided a majority divided recap for the common majority equity holders of the business and was followed by an additional tranche of Alaris capital to help fund greenfield expansion and an acquisition in California, 9 years later.

Alaris’s structure allowed management to have patience and find the right acquisition versus an aggressive acquisition strategy.

- Width: wide

- Align: left

- Color: gray

- Image:

Generational Transfer

Business Owners who want to experience a liquidity event today, but are adamant about keeping the business in the family and maintaining the culture they have successfully built, have used Alaris to accomplish these goals.

End of the Roll

Exited

End of the Roll

Case Study

Description

2005

US$7.2M

Canada’s largest dedicated flooring retailer.

Situation

End of the Roll was seeking a capital provider that could provide founders with liquidity while allowing for a second generation to become the owners of the business.

Maintaining the culture that they had established was key to the owners.

Outcome

“End of the Roll has been our longest serving partner, spanning 13 years. We have been very lucky to have been involved in such a fine company and with such fine people for that length of time. Alaris was able to help in a generational transfer liquidity event for End of the Roll 13 years ago and the results could not have worked out better for both sides. The second-generation management was able to retain full control and independence and grew the company at their own pace and keep a legacy asset for as long as they want. We are pleased to be one of the only capital providers that could have constructed this outcome.”

– Steve King, CEO, Alaris

- Width: wide

- Align: left

- Color: white

- Image:

Recapitalization

Business Owners who are looking to eliminate refinancing risk, have access to follow-on capital from a true long term equity partner and want to benefit from the majority of the upside from the growth that they deliver have used Alaris to recapitalize their balance sheet.

Killick Aerospace

Exited

Killick Aerospace

Case Study

Description

2011

$41.3M (3 tranches)

Global supplier of aircraft MRO and inventory management.

Situation

Killick was looking to refinance their balance sheet in an effort to create more flexibility to pursue their long-term growth objectives.The growth strategy for their MRO business required a partner who would allow them to acquire new inventory without having restrictive covenants prevent them from doing profitable deals.

Outcome

Alaris’ investment allowed the company to pursue its long term growth strategy. The company immediately realized a dramatic increase in EBITDA with Alaris’ participation in the growth being capped by the collar.

Alaris provided follow on investments for multiple acquisitions in the MRO space, as well as for liquidity to certain equity holders

Killick was acquired in 2015 whereby the common equity holders garnered a disproportionate amount of the proceeds received on the sale due to Alaris’ capped exit proceeds and benefited greatly from Alaris’ limited participation in growth.

Sandbox

Exited

Sandbox

Case Study

Description

2016

US$35.0M (2 tranches)

Full service marketing and advertising agency.

Situation

The management group at Sandbox had been executing a strategy to acquire regional marketing communication companies that complement the agency’s current operations, which will further diversify the existing client base, skill set, and industry experience.

As the company looked to continue to execute upon this business model, they were in search for a capital partner who shared their long-term vision to build out a world class marketing and advertising agency at a pace that made sense for the long-term health of the business.

Outcome

Alaris’ first investment in Sandbox allowed the company to recapitalize its balance sheet and set the company up with access to further capital to fund its growth strategy.

Sandbox management has the ability to continue to grow their business via acquisition knowing they have a long-term capital partner in Alaris who can help fund that growth for an indefinite time period. This has already proven valuable as Alaris has provided a second tranche to fund an acquisition for Sandbox.

At the same time, the culture instilled in the business was preserved which was paramount to the success of the business plan.

Accscient

Accscient

Case Study

Description

2017

US$38.0M (4 tranches)

Leading provider of IT Consulting, Staffing and Outsourcing Services.

Situation

Accscient was seeking a partner to help position the company to capitalize on long term growth initiatives.

Outcome

Alaris’ initial investment was used for retiring mezzanine debt and for general working capital purposes.

"Accscient is a multi-company organization led by several entrepreneurial Presidents with businesses, goals and aspirations that are aligned. Alaris encouraged us to meet with both the members of their team, and their business partners, and we quickly determined that our goals, cultures and aspirations were also aligned with theirs. In our world of complex financial structures and transactions, we were fortunate to have had supportive partners in the past which allowed us to get to this juncture but, finding a partner that is 100% like-minded, has been one of my greatest challenges for the past 2 decades. I firmly believe Alaris is that partner."

– Sravan Vellanki, Chairman & CEO, Accscient